Meet Shelly Poteet

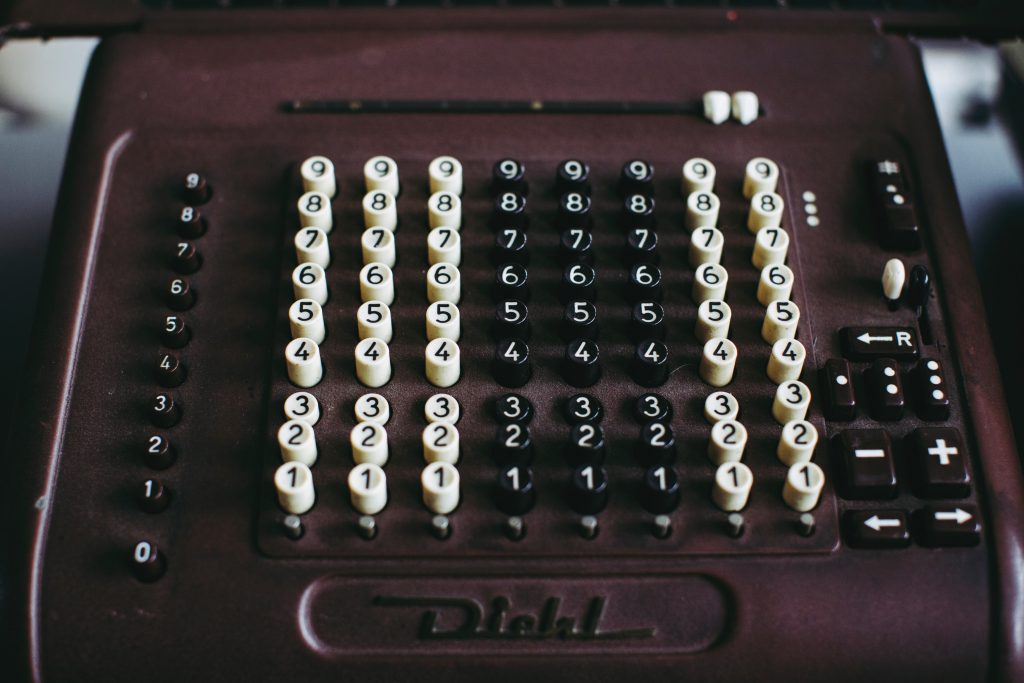

Shelly is a lifelong resident of Napa, California, with over 30 years accounting experience and 13 years in the wine industry. She started her accounting career, in 1984, at a local bookkeeping and tax service. At that time, there were no computers, everything was processed manually, and ledger sheets were used to produce financial statements! This experience taught her first hand knowledge about the true foundations of accounting. In 1995, she worked for a local CPA firm preparing individual, partnership and corporate tax returns. Her clients ranged from small wineries and vineyards to large multi-entity wineries as well as construction and retail businesses. For several of these clients, Shelly served as a consulting controller.

In 2012, Shelly went into the private industry and spent seven years at Copper Cane as the controller building the company’s finance and accounting department that managed eight different related party LLCs. She was on the management team that facilitated the successful sale of one of the winery’s major wine brands, Meiomi, to Constellation.

Seeing a need in Napa Valley for consulting controller services along with accounting and bookkeeping, Shelly started Poteet Accounting Group in 2020. Her experiences in public accounting and private industry provides a unique skill set for smaller companies and a higher level of consulting in lieu of the expense of having a full-time controller on payroll.

When she’s not taking care of her clients, Shelly spends time with her family. She is married to a Richmond Fire Department Fire Captain and is the mother of three grown sons. Two young grandchildren keep her busy while a recreational home in Lake Almanor provides her a place to relax. She is an avid dog lover too.

Expertise Areas

- Financial reporting, budgeting, forecasting, sales analysis and cash management

- In-depth experience with financial management and accounting operations: general ledger, financial reports, banking relationships and reporting; annual audit management and preparation; payables, receivables, payroll, time and billing, fixed assets, inventory, job profitability; sales, use, and excise taxes

- Operations: Business closings, financial requests and audits, trade buyer negotiations, and lease resolutions